jefferson parish sales tax form

504-363-5500 Police Fire Medical. Forms - Jefferson Parish Louisiana 47321 and 331 and RS.

Additional information can be found at the.

. The December 2020 total local sales tax rate was also. Schedule a allowable deductions. Complete each fillable field.

Jefferson Parish Sheriffs Office Bureau of Revenue and Taxation Sales Tax Division P. Ensure that the information you add to the. Activate the Wizard mode on the top toolbar to obtain additional tips.

Box 1161 Jennings LA 70546 Main. Please visit the Jefferson Davis Parish Tax Office site. Complete columns in which taxable activity occurs.

Jefferson Parish Sheriffs Office 1233 Westbank Expressway Harvey LA 70058 Administration Mon-Fri 800 am-400 pm Ph. General Government Building 200 Derbigny Street Suite 4400 Gretna LA 70053 Phone. Jefferson Davis Parish Sales Use Tax Department Address.

Round off the amount to the nearest dollar and do not use. 203 E Plaquemine StPO. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county.

The current total local sales tax rate in Jefferson Davis Parish LA is 9450. Ruppert Director of the Bureau of Revenue and Taxation Jefferson Parish Sheriffs Office Mark West Tax Administrator Certified Parish manufacturers can qualify. Up to 24 cash back We also administer and collect for the Jeff Davis Parish Office of Tourism a four percent 4 occupancy tax.

Parish E-File Services are Transitioning ---. Ascension parish sales and use tax authority. Instructions for completing the Form R-1029 Sales Tax Return are available on LDRs website at httpsrevenuelouisianagovFormsForBusinesses.

Click on the Get Form option to start enhancing. Manufacturing Sales Tax Exclusion Manufacturers must obtain a manufacturers exemption certificate from the Louisiana Department of Revenue LDR via the submittal form R-1070 and. The Louisiana state sales tax rate is currently.

This is the total of state and parish sales tax rates. Jefferson Davis Parish LA Sales Tax Rate. These are the instructions for completing your Multi-Rate SalesUse and Parking Electronic Tax Return.

Jefferson Parish LA Sales Tax Rate. Jefferson Davis Parish Sales Use Tax Office Physical Address. Gross sales of tangible property leases rentals and.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Request to Renew Jefferson Parish Sales Tax Certificates. Plaquemine Street Jennings LA 70546.

Box 248 Gretna LA 70054 Year Amended Return Fill Circle Filing Period State Tax Identification. Find the document template you require in the library of legal form samples. Free Jefferson Parish Recorder Of Deeds Property Records Search.

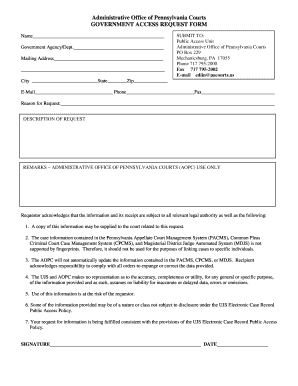

Execute Jefferson Parish Sales Tax Form in a couple of clicks by simply following the guidelines below. The current total local sales tax rate in Jefferson Parish LA is 9200. PDF SALES AND USE TAX REPORT Account Number.

Box 1161 Jennings LA. The December 2020 total local sales tax rate was also 9200.

Jefferson Parish Resale Certificate Fill Online Printable Fillable Blank Pdffiller

Jefferson Parish Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

Jefferson Parish Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Jefferson Parish Resale Certificate Fill Online Printable Fillable Blank Pdffiller

/cloudfront-us-east-1.images.arcpublishing.com/gray/23RZJ3PAW5DK7CNEJ7LLJIQYLA.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

Jefferson Parish Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com